Renters Insurance in and around Riverside

Your renters insurance search is over, Riverside

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through coverage options and savings options on top of keeping up with friends, work and family events, takes time. But your belongings in your rented townhome may need the incredible coverage that State Farm provides. So when trouble knocks on your door, your home gadgets, sound equipment and clothing have protection.

Your renters insurance search is over, Riverside

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like the least of your concerns, and you're wondering if it can actually help protect your belongings. But pause for a minute to think about what it would cost to replace all the stuff in your rented home. State Farm's Renters insurance can help when unexpected mishaps damage your possessions.

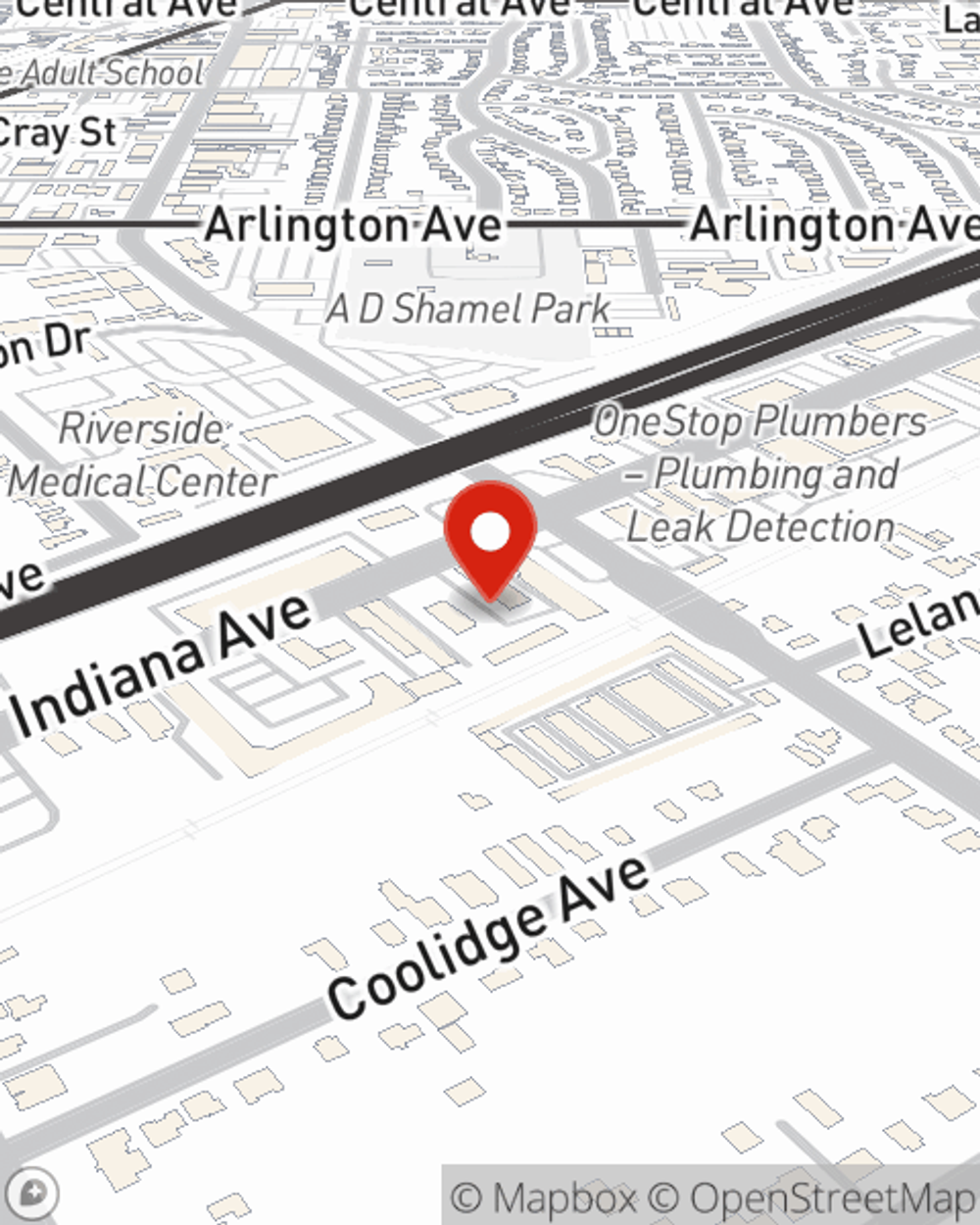

State Farm is a value-driven provider of renters insurance in your neighborhood, Riverside. Reach out to agent Scott Fowler today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Scott at (951) 777-2446 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Scott Fowler

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.